HR & Payroll Software That Grows With You

Start with basic HR and Payroll tools and upgrade as you grow, or integrate your existing payroll with our HR software.

PrimePay Payroll

Payroll is more than just an item to cross off on your to-do list. To us, it’s an opportunity to elevate the ordinary and create a lasting impression on your business’ very core – Your people.

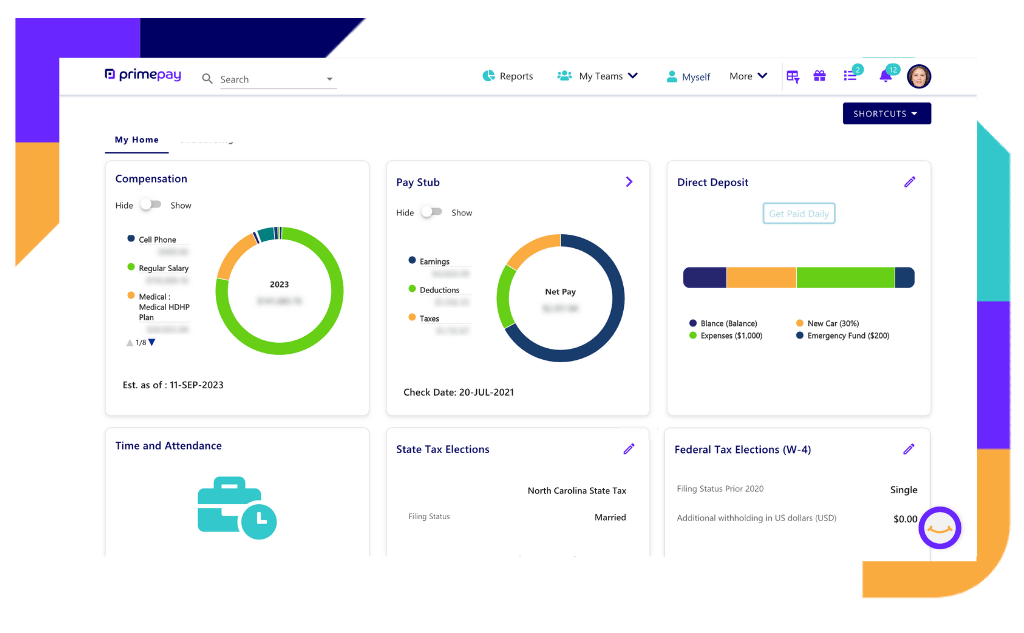

Payroll Software that is simple to use, accurate, and compliant, and integrates seamlessly with time-tracking tools.

What makes us different from the competition:

As payroll technology becomes more accessible, cost-effective, and simplified for end users, more businesses are opting to run their own payroll versus outsourcing. As a leader in payroll and client experience for 37+ years, PrimePay’s payroll technology streamlines payroll processing for greater control, efficiency, and understanding of your business.

PrimePay’s payroll module integrates seamlessly with our time and HR modules, as well as other third-party providers, for a scalable solution that can adapt and grow with your business.

Popular Features:

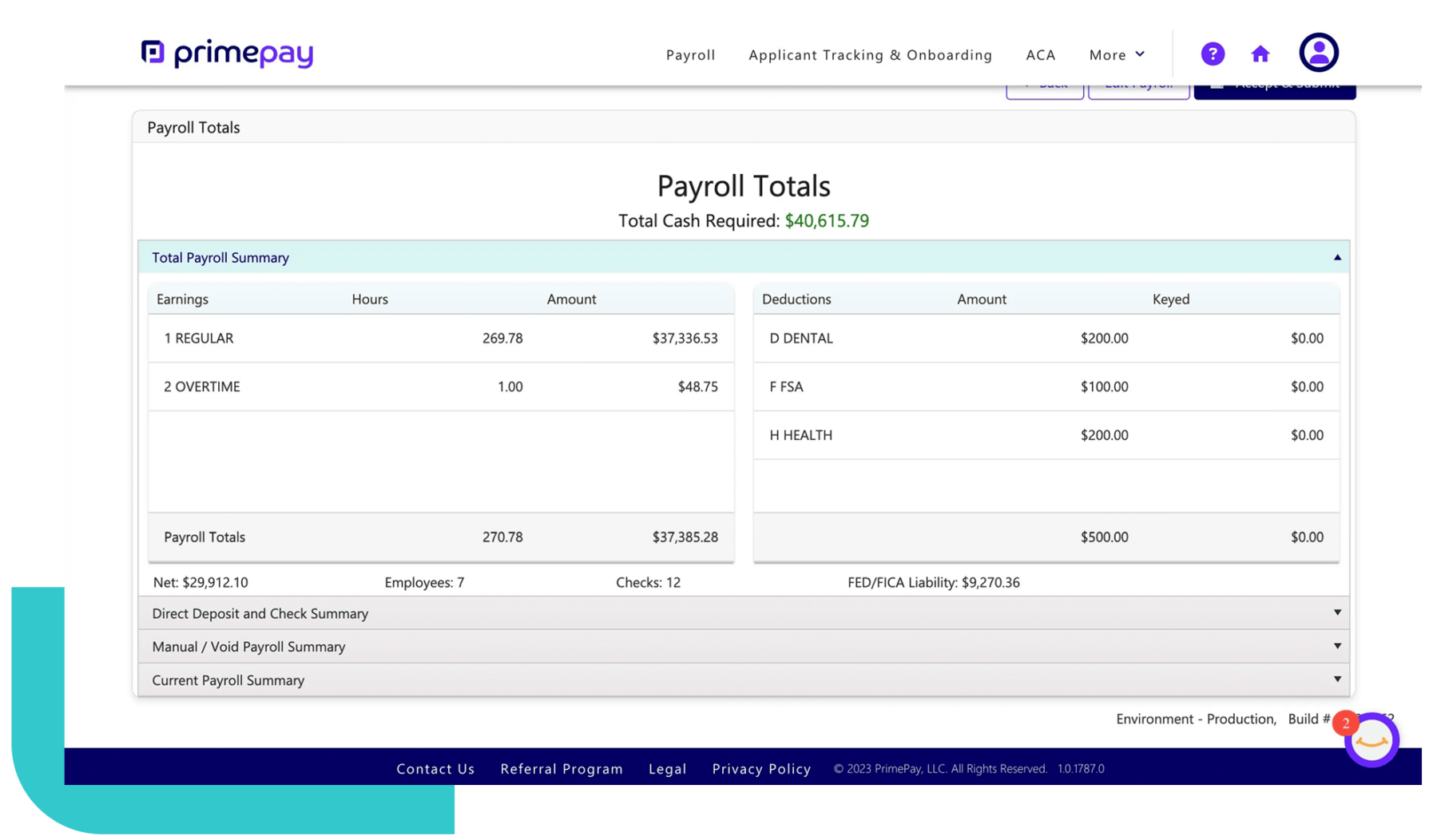

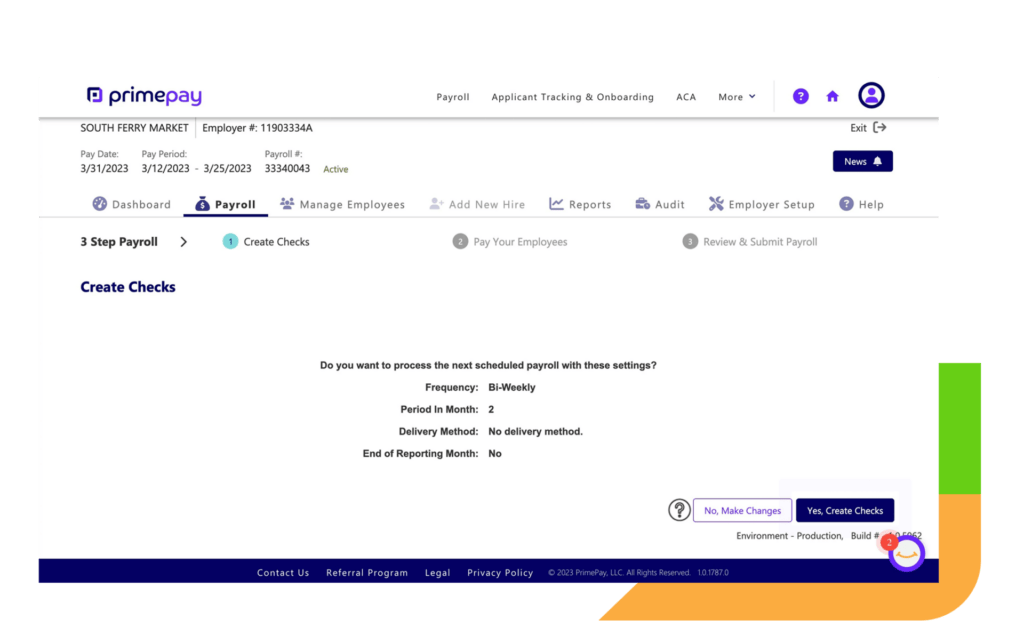

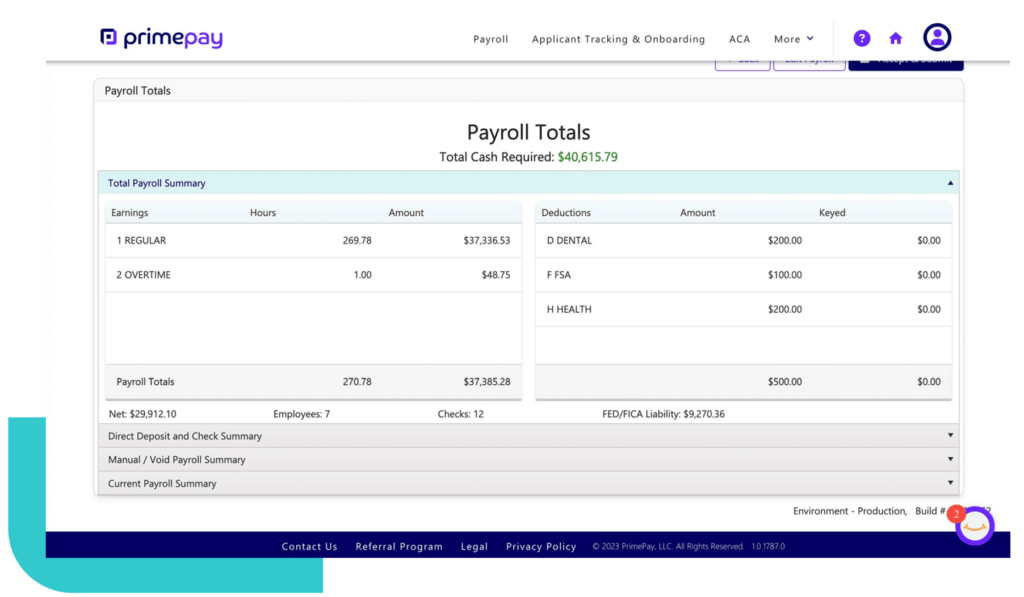

Cut down on manual work and reduce pay errors with automated payroll processing that ensures all employee deduction and tax data are captured and included in your payroll run for accurate worker pay every time.

Popular Features:

Stay in compliance with payroll technology that proactively alerts you to errors with your payroll data so you can correct, commit and continue to focus on growing your business.

Popular Features:

With PrimePay, Employees can access their earnings as soon as they clock out and don’t need to wait until payday. Offering on-demand pay as a benefit can increase employee satisfaction and retention, as it provides your team with greater financial flexibility and control.

Popular Features:

“The solution’s automation functionality means that activities like payroll processing and validation that used to take us 15 or 20 hours per week can now be done in a matter of minutes.”

Jeff Berliner, Chief Information Officer, Institute for Advanced Study

Start with basic HR and Payroll tools and upgrade as you grow, or integrate your existing payroll with our HR software.

Essential payroll functions with workers’ comp.

Everything in Payroll Essentials, and Time.

Keep your payroll and add essential HR fast and affordable.

Everything in Payroll Essentials and HR Essentials.

Payroll, HR, and Benefits Administration in one unified platform.

Payroll, HR, Benefits Administration, and Time in one HCM suite.

Whether you are just getting started on your in-house Payroll Software journey, or narrowing your list of finalists to reach out to, below we have pulled together some helpful resources.

This is one of the easiest decisions you can make,” says Patrick O’Hara, Chief Performance Officer. “A benefit that delivers value to our employees and doesn’t cost them or the company anything? It’s a no-brainer.”

Some payroll challenges include compliance with laws and regulations, managing a hybrid workforce, manual methods, and complex systems. With the right HR and payroll technology solution built for the specific needs of small businesses or established businesses alike, you can streamline and simplify the entire payroll function for your business. A single, automated system with paperless workflows and centralized payroll- and HR-related data allows you to:

Finding the right payroll software for your business is like choosing a pair of shoes; it needs a perfect fit, optimal functionality, and value for money. The ideal software should cater to your specific needs, be it managing payroll software for small businesses or providing a full-service payroll solution for larger firms.

Optimal payroll software should include features like automatic tax filing, unlimited payroll runs, and smooth integration with accounting tools. Also, consider factors like the cost of the software, the provider’s support, and the ease of payroll processing.

Ultimately, the goal is to streamline your payroll tasks and improve the efficiency of your processing payroll operations.

The journey to streamline your payroll begins with assessing your payroll requirements. Whether you’re running payroll for a small business or a large corporation, your payroll software should be tailored to your specific requirements.

The software should accommodate various pay rates for hourly employees, and it should be flexible enough to adapt to the unique requirements of your industry. It should also offer additional services such as HR services, health benefits, and direct deposits. Remember, a basic payroll solution may suffice for some businesses, while others may require a more comprehensive payroll solution from a reliable payroll provider.

Consideration of the software’s integration capabilities with your current accounting tools is vital when selecting payroll software. Seamless integration ensures smooth financial management, streamlines payroll processes, and saves resources.

Some of the best payroll software on the market, provided by leading payroll software companies, offer integration with popular accounting tools like Gusto and QuickBooks. This allows for smooth data transfer, automated payroll calculations, and generation of financial reports using payroll data, thereby enhancing efficiency and minimizing errors. Additionally, considering the payroll software cost can help businesses make informed decisions when selecting a suitable solution.

Ensuring legal compliance is a significant aspect of payroll management. Your chosen software should include robust compliance and tax features for strict adherence to all applicable regulations.

Key features to look out for include:

Although there are several interpretations of the word “payroll,” it usually refers to the complete process of paying employees. There are many moving pieces in payroll, and their functions go far beyond ensuring that employees are paid accurately and on schedule. Payroll involves adhering to constantly changing tax filing and wage regulations, paying payroll taxes, keeping track of necessary paperwork, managing benefits, making sure there is enough cash on hand to pay for payroll costs, and even maintaining employee satisfaction.

Managing your payroll doesn’t have to be a headache. With the right software, you can simplify the entire process payroll, from calculating wages to generating payslips. A simple payroll system can automate payroll tasks, allowing you to focus on growing your business.

Automated payroll systems offer several benefits, including:

Businesses have transformed how they manage payroll via automated payroll systems offered by various payroll companies. By automating repetitive tasks and minimizing the risk of human error, these systems improve accuracy and productivity. These systems ensure high accuracy through:

Key features to look out for include:

Another feature simplifying the payroll process significantly is direct deposit. It allows employers to deposit salaries directly into employees’ bank accounts, eliminating the need for physical checks.

Direct deposit offers several benefits:

Implementation of a payroll software solution brings a key benefit: streamlining payroll tasks. By managing repetitive and manual activities such as data entry, form completion, and notification distribution, businesses can save substantial time and reduce errors.

Optimizing payroll tasks offers numerous advantages, including:

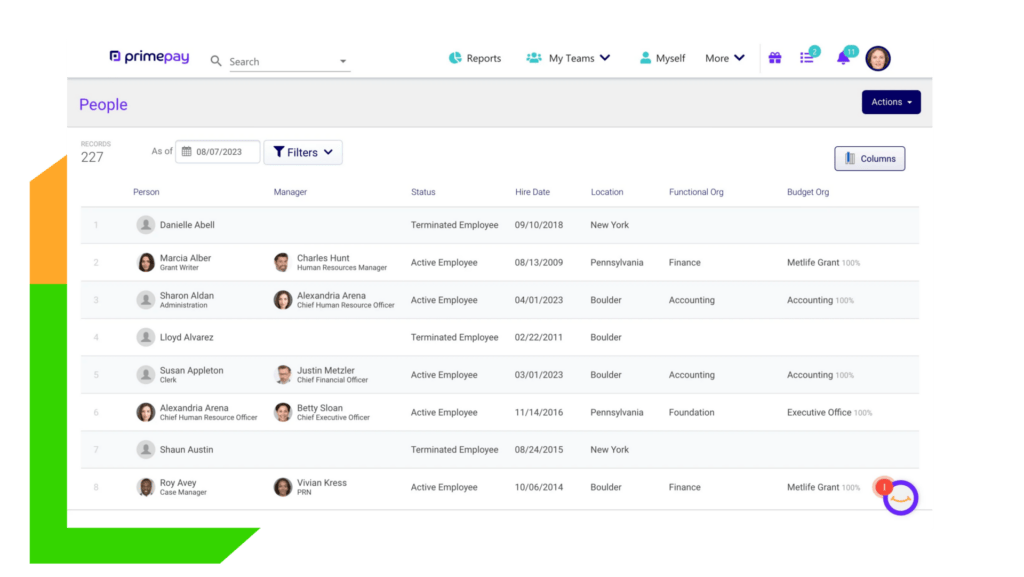

In the current digital era, online payroll systems significantly enhance employee access and engagement. These systems offer self-service portals and time tracking integration, enabling employees to access their payroll information and manage their personal data effectively.

Online payroll systems improve employee engagement by providing intuitive platforms that enable employees to complete tasks related to payroll and HR information. With features such as self-service portals and time tracking integration, these systems not only streamline the payroll process but also enhance the overall employee experience.

Online payroll systems prominently feature employee self-service portals. They empower employees to independently access their paystubs, pay history, and payroll information without the need for HR intervention.

These portals offer a range of features such as:

By providing employees with the tools to manage their own information, businesses can enhance efficiency and improve the employee experience.

Another key feature of online payroll systems is time tracking integration. It ensures accurate and efficient payroll processing by enabling precise tracking and calculation of employees’ hours for payroll.

Integrating time tracking systems with payroll software offers several benefits, including:

Payroll software integrates with other important business processes to guarantee that employees receive their direct deposit, paychecks, earned wage access, or pay cards accurately and on time. It helps to reduce operational complexity and reliance on multiple suppliers, payroll systems, and partnerships with a global solution from a single payroll provider.

An online payroll solution includes many pros such as eliminating time-consuming tasks, and instead, simplifying operations, enabling automation, improving employee morale, minimizing compliance risk, hands-on customer support, and more. The best payroll software will also be user-friendly, and include several add-ons such as an employee portal for easy access to employee information needed for other administrative duties, and more that makes this a better option than doing payroll and HR in-house. But it does also include some cons, such as loss of some control over the payroll process, often paying additional fees for services you don’t need from big-box providers, and although the task is passed onto a third party, you are still ultimately held responsible for how it’s done, and for its accuracy.

We offer full product support to our clients, as well, a full managed service.